Farm

Our Investment in Farm

The Dust Bowl of the 1930s was a catastrophe for the Great Plains region in the United States as well as the entire country, which had grown to depend on its vast grain supply. At the turn of the 20th century, an influx of inexperienced farmers arrived with a misunderstanding of its ecology. They assumed the few wet years that blessed their arrival represented a pattern, instead of the aberration it is now seen in retrospect. A boom in agricultural activity in the Great Plains was driven by the need to feed legions of troops in World War I. Plowing tore up deep-rooted native grasses that had held topsoil and moisture in place through periods of drought and high-winds. When the droughts of the 1930s dried out the disturbed topsoil into fine particulates, winds whipped up massive dust clouds and transformed the region into a barren and desolate landscape. The Dust Bowl affected one hundred million acres of American farmland and dropped the per-acre value of property by nearly 30%.

The past few decades have been marked by a further expansion of agriculture into wild grasslands. This has led some to label this period as the second Dust Bowl and call for the urgent need for land restoration, which would be a boon for both the area’s ecology and for carbon drawdown. There are three and a half million acres of land available for sale across the United States today, representing an opportunity to purchase land and actively manage it for the benefit of native ecosystems and the climate. However, many obstacles stand in the way for meaningful land restoration: identifying and evaluating appropriate parcels of land is tedious; managing investments and tracking the environmental impact is neither simple nor cheap; and the opportunities to share ownership among other investors is limited.

Farm, based in Ft. Collins, Colorado, is addressing these pain points and solving for the need to invest in land stewardship projects in ecologically fragile places like the Great Plains. Its investment platform allows accredited investors to contribute capital seamlessly in projects, aiming to revitalize and repurpose the land toward climate-friendly activities. We’re excited to announce our investment in Farm, and its founders Tim Luckow and Jovin Cronin-Wilesmith, as they leverage technology and finance to bring new life and funding to critical ecosystems.

What is Farm?

Farm is an innovative investment management platform that seeks to rejuvenate land in the U.S. by channeling investments in projects, geared toward land stewardship. Its work aims to deliver tangible benefits that will lead not only to revitalized ecosystems, but also by returning the carbon capture ability to restored soil. In addition, the projects it funds include repurposing the land for sustainable commercial activities, like solar and wind energy generation.

Farm’s platform reduces friction between investors, who may include institutions, individuals, and other stakeholders in the land. The platform accomplishes this by leveraging proprietary data and analytics that enables Farm to evaluate the investment and climate opportunity of land prospects. Some of the data Farm sources include a land’s historical rainfall, solar irradiation, proximity to transmission lines, soil quality, and property value. By analyzing a trove of diverse data, Farm is able to identify undervalued land that represents meaningful upside potential both in terms of a return on investment as well as benefit to the climate. With a goal of facilitating one billion dollars of land transactions by 2025, Farm aims to maximize income streams for a given land asset and provide visibility into how an asset is performing financially and environmentally.

For those interested in opportunities to invest in land stewardship, Farm invites you to complete a quick form to better understand your goals.

Why did we invest?

Compelling Founder-Market Fit

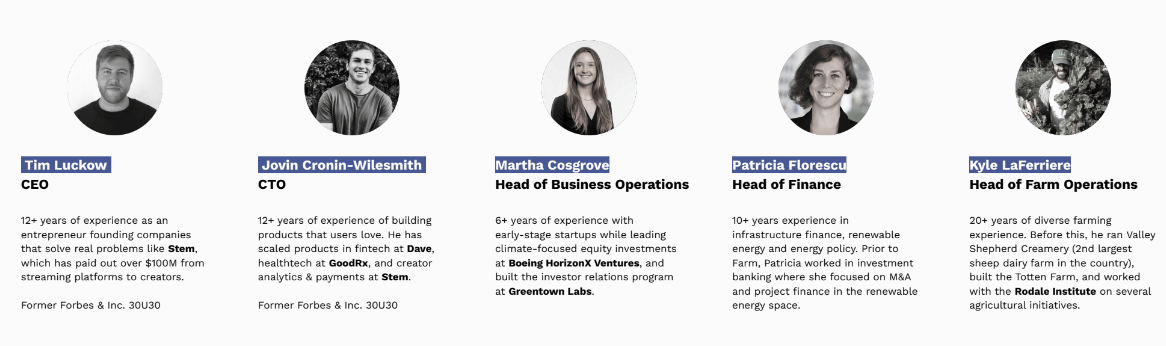

Key to the success of Farm’s mission is creating a digital marketplace, managing voluminous amounts of data, and leveraging insights to drive optimal investment decisions. To that end, the team is well-equipped with the appropriate talent. CEO Tim Luckow brings with him business experience starting multiple companies in the music and entertainment industry that have distributed over $100M to artists and their teams. CTO Jovin Cronin-Wilesmith brings with him a background of developing disruptive tech products in entertainment, health, and finance. Both Jovin and Tim share the unique distinction of being recognized in Forbes’ “30 Under 30” list of entrepreneurs as part of their last company.

Martha Cosgrove, Patricia Florescu, and Kyle LaFerriere round out the Farm founding team. Collectively, they bring a variety of relevant experience to the company from places like Boeing HorizonX Ventures and Greentown Labs and from tenures in renewable energy financing and farming operations. Earlier this year, Farm joined the Techstars Boulder program.

A Platform Solution for Land Stewardship

One of the reasons that we were attracted to Farm was the opportunity to leverage land stewardship as a climate solution in a way that was digital, seamless, and scalable. Farm is a platform that represents potential for scale in a sector where there remains a lot of unmet needs for land owners. It allows visibility into both the financial and environmental opportunity of a land investment as well as offers a means to measure its impact.

The decentralized ownership model brings meaningful innovation to the land investment world and allows for more people and institutions to support the stewardship of native ecosystems while generating financial returns. Farm is poised to invigorate the land stewardship movement and create fertile ground for sustainable activities.